From 2013 to 2016, we have monitored on China's wire and cable enterprise competitiveness for three consecutive

years. On three years in-depth analysis of the data, we have got a series of meaningful result. On one hand, the result

illustrated the change of China's wire and cable enterprises competitiveness. On the other hand, the data of these

enterprises shows the progress and issues of China's wire and cable market.

1. The stability and objectivity of China's wire and cable enterprises competitiveness

The enterprises competitiveness is accumulated in the long-term development, so we can predict that overall, the

result of China's wire and cable enterprise competitiveness is of strong stability. But due to its forming and changing

in the progress of competition, the enterprises competitiveness monitored in each year would have certain difference.

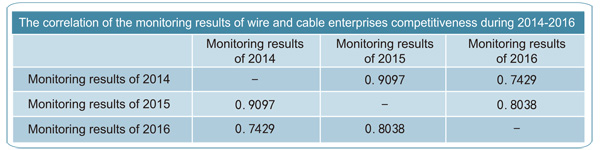

By statistical analysis of the result of the three year's monitoring, it can be found from the following table that:

(1) The monitoring results of enterprises competitiveness in the 3 years have strong correlation, and the correlation

coefficient is above 0.7.

(2) The correlation coefficient of 2014 and 2015(0.9097) is above it of 2015 and 2016(0.8038). It matches the

market deepening of China's wire and cable and the speeding up of the enterprises competitiveness changes.

(3) The correlation coefficient of 2014 and 2015(0.9097) is above it of 2014 and 2016(0.7429), which shows that

the correlation coefficient of the competitiveness monitoring results in the 3 years can really reflect the stability of

China's wire and cable enterprises competitiveness. We can speculate that the change of China's wire and cable

enterprises competitiveness in 2 years would be greater that of 1 year, therefore, the correlation coefficient should

decline with the increase of the time interval. The conjecture above was confirmed by the data.

2. The increase of the competitiveness differentiation in China's wire and cable enterprises

We calculated the variation coefficient of the return on net assets in 2014 and 2016. The results show that in 2016 variation coefficient of return on net assets (value of 53) is far more than that of 2014(value of 39) in China's wire and cable enterprises, which indicates the increase of the competitiveness differentiation. This may be the signal of continuous improvement in China's wire and cable market. The overall competitiveness of China's wire and cable enterprises has been increasing incessantly, and the competitiveness differentiation are also increasing. Therefore, we speculated that for the several top competitive enterprises in China's wire and cables industry, the competitiveness would not decline, but continue to increase.

3. Market-oriented process of China's wire and cable market

The competitiveness fundamental data is classified into 3 sorts of sub-sectors in the competitiveness monitoring systems, which are scale sub-sectors, growth sub-sectors, and efficiency sub-sectors. Scale sub-factors describe the absolute amount of the enterprises competitiveness. In general, the larger the enterprises are, the stronger competitiveness the scale sub-sectors reflect. Scale sub-sectors include net profit, revenues, and net assets. The efficiency sub-factors describe the relative volume of the enterprises competitiveness. They may not show strong competitiveness in large enterprises. Efficiency sub-sectors include the return on net assets, the return on total assets,revenues per employee and the ratio of export revenues to total revenues.

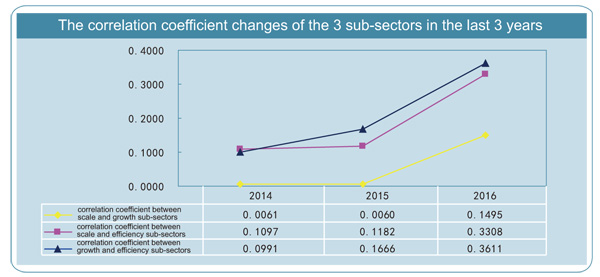

Scale sub-sectors, growth sub-sectors, and efficiency sub-sectors measure the competitiveness of enterprises from different aspects. We hope that for all the samples, the three sub-factors are not relevant, at least less relevant, so that it can reflect the whole competitiveness of China's wire and cable enterprise more fully. However, we can also predict that in the maturing of China's wire and cable market, due to the regulating role of market mechanism, the 3 aspects is bound to have some relevance, especially between the efficiency sub-sectors and growth sub-sectors, demonstrating the resource configuration to the most efficient enterprises.

The Chart below indicates that on the whole, the correlation of the 3 sub-sectors is increasing. This shows that

China's wire and cable market becomes more and more market-oriented, efficiency-based, and allocating production

elements on the power of market. Through the data above, we can conclude that the competition has become

increasingly heated and polarized in China's wire and cable market. The stronger stronger, and the weaker weaker.

The dominant position of competitive advantage of the scale is increasingly obvious in China's wire and cable

market.

The topic our competitiveness report study in 2016 is the impact of the cost of China's wire and cable on the

competitiveness of the enterprises. The results show that at present, wages, energy price that people concerns have quite

large impact on the profitability of the enterprises. Generally speaking, some competitiveness wire and cable enterprises

in China are able to bear the pressure caused by the higher wages and energy prices. The results also show that marketoriented

of interest rate will not over-affect the international competitiveness of China's wire and cable enterprises, on

the contrary, in response to the "capital substituting labor " caused by rising wages, those competitiveness wire and

cable enterprises should accelerate their pace of capital market as well as internationalization.

When accepting the conclusions above, it should be pointed out specially that: although the impact of the factors

above respectively on the enterprises cost can be endured by the wire and cable enterprises, but if the factors

occur at the same time, it may be difficult to handle in a short period. Faced with large changes in cost structure,

enterprises need a period of adaptation and adjustment to accept the increased pressure resulting from the integrated

costs. So we believe that although the competitiveness wire and cable enterprises in China have the ability to accept

the change of cost structure in long term, at present, when a variety of economic uncertainties occur in China and the

global economy may step into a period of serious decline due to Brexit (Britain + Exit), if the factors driving cost

rising come out in a short term, many China's wire and cable enterprises might be caught into financial difficulties.

In the end, on behalf of all stuff of Accreditation Committee and Organizing Committee of "the top 10

competitiveness enterprises in China's wire and cable industry", I extend my greetings to all the colleagues in this

industry for your support and concern on the selection in the last 3 years. In the coming year, we will transmit the

forefront and precious information to industry as always, and contribute to improving the competitiveness China's

wire and cable enterprises.

Accreditation Committee of "the top 10 competitiveness enterprises in China's wire and cable industry"

Sep. 2016